This investment often goes unnoticed, but without it rail freight would not be progressing as it is.

And yet if you are a major port, for example, you might consider such investment a leap of faith. You have no control over rail paths on the network. There is no way of securing capacity to enable your investment to be used in the future. The access charge process is profoundly complex. You’re not even consulted on network changes that might affect your traffic, while engineering work schedules are planned at whim.

This is not in any way to criticise the rail operators who work tirelessly to represent the needs of their customers in all these areas. But as rail freight becomes increasingly competitive, many customers are seeking their own relationships with government, Network Rail and the Office of Rail Regulation, to gain influence.

The key issues

Despite the diversity of the market, some common customer priorities are emerging.

Top of the list is cost. For freight customers, there is a much closer correlation between operational costs and the price they actually pay than there is in the passenger sector. So, for example, Network Rail’s efficiency targets have little (if any) impact on rail fares, but make a direct impact on rail access charges and hence costs to customers.

For elastic markets such as intermodal, rail must compete directly on cost with HGVs. The road market is fast moving, competitive, flexible and (with road fuel duty now held for a fourth year) increasingly cost-effective. Customers such as Tesco price check on a regular basis, and will revert to road as soon as the cost margin tips even a few pence. Rail has different advantages, but they are all secondary to the bottom line.

Even in sectors such as coal, and perhaps steel, where some goods are captive to rail, costs are still a major consideration.

Transport prices influence decisions over where facilities will be located, upgraded or closed. And in a global economy, the decision whether to invest in the UK or elsewhere is nudged by many factors, of which transport is one. So while these customers are unlikely or unable to use road, they are still keenly astute on rail costs.

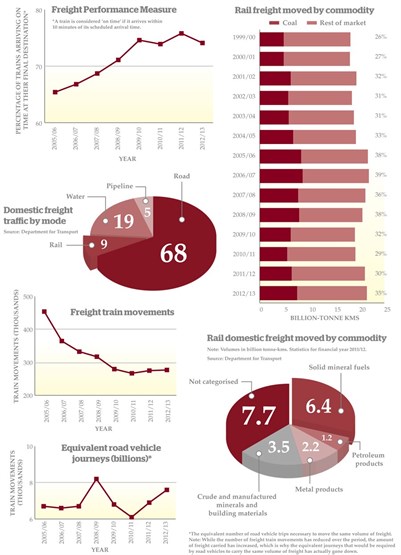

A key element in reducing costs is increasing the efficiency of rail freight operations. There have been significant gains in staff productivity, asset use and train loading. There are a third fewer freight trains running than a decade ago - yes, fewer - and yet each train is moving more than 50% more goods than it did then. Longer, better-loaded and heavier trains are becoming the norm across the network.

But there is still far more to do. Average freight train speed is a derisory 25mph, and is worse in some cases. If trains sit idle in loops they are still consuming both fuel and driver hours, limiting the number of daily trips each locomotive and wagon set can make. As trains get longer and heavier, their ability to easily accelerate and decelerate in and out of loops is compromised, which brings performance risk. And on top of this there can be inefficiency in terminals and ports, which is often compounded by poor alignment of network and terminal capacity and performance.

This is not easy to unlock, but if rail freight is to take the next step in efficiency - and, dare we say it, pay any more for access - this must move forward. Customers are beginning to understand the issue and to play their part in finding solutions, but it requires collaborative working between Network Rail, operators and customers.

One of the reasons why asset use is difficult is because rail freight is restricted (for good reason) during the passenger peaks, and then constrained overnight by engineering work schedules. You can use a lorry 24 hours a day, but rail has much lower availability.

Over time there have been numerous studies on efficient engineering work (most recently from the Rail Delivery Group), concluding that more work is needed at weekends, or overnight, or in short blocks, or long blockades, and so on. Yet there seems to be little progress in arranging the work to enable freight (and passenger) trains to keep moving.

Even where diversionary routes have been provided, Network Rail seems incapable of scheduling work to keep one route open at all times. The Port of Felixstowe sees 60 daily trains Monday to Friday, but not a single one on Sundays, as the engineering schedules cannot guarantee a path.

Customers cannot understand this, and are frustrated at the seeming indifference to opening up this capacity for their use. It is particularly vital for the retail sector, which needs Sunday deliveries for store replenishment.

Making more use of capacity at weekends and overnight may seem to be an impossible challenge to some, but as the rail network becomes increasingly constrained it is surely a must.

Ports and developers planning to construct rail-linked facilities need to understand that they can get a return on their investment, running the services they expect on the network, not just today but also in the future.

As the network gets more and more full, there is a danger that investor confidence will be undermined by the perception (if not the reality) of limited capacity. This is why we are pressing for early certainty over the freight benefits that might be delivered by HS2. We are also keen that Network Rail continues to make progress on delivering and securing strategic freight capacity on the core routes.

Suppliers

Although we have talked mainly about rail freight customers, the supply sector is equally vital to the success of the industry.

Modern locomotives and wagons are critical to achieving enhanced payloads, improving acceleration and braking, and delivering efficiency. Handling equipment, cranes, reach stackers and such like can make the difference in terminal operations, while digital technology also has a major role to play.

The supply industry has invested in research and innovation, but will only do so where it is confident it can make a return, and (like freight customers) its voice is perhaps underplayed in the debate. Perhaps this is an area for the newly established Rail Supply Group to pick up.

Making progress

Despite the challenges, there are encouraging signs of progress. Network Rail’s freight team has committed more time and resource to end customers with positive results, collaborating on projects such as control rooms at Immingham and Drax to encourage right time performance.

End customers are becoming more aware of wider sectoral issues, helping to inform their decision-making and to understand the challenges and opportunities faced.

The operators are becoming increasingly comfortable with the new order, and are working together more than ever before. And even the ORR has promised a freight customer panel.

Recognising the voice of the freight customer isn’t just a ‘nice to have’, it’s how we will unlock the true benefits of the competitive, private rail freight sector. Working with the rail operators, a collaborative approach is the only way to achieve the next tranche of efficiency benefits, and to secure ongoing investment.

And understanding the diversity of rail freight customers, and why they expect something so different from the rail passenger, is an important education for all in our industry.